Tutorial Categories

Last Updated: January 12, 2026 at 17:40

Investing Mistakes You’re Making Without Knowing (Series Intro: Behavioral Finance & Market Psychology Explained)

Are you making investment mistakes without even realizing it? From panicking during market crashes to holding losing positions for too long, human behavior often sabotages our financial decisions—no matter how smart we are. This is the introduction to our Behavioral Finance series, where we reveal the psychology behind every market move, show how legendary investors think differently, and teach you how to see patterns that most people miss.

When Human Emotion Overrides Financial Wisdom

Have you ever sold an investment in a panic during a market dip, only to watch it soar months later? Or clung stubbornly to a losing stock, convinced it must bounce back? If this sounds familiar, you’re not irrational—you’re human. Welcome to the revelatory world of behavioral finance, the field that exposes why our financial brains are often our own worst enemies.

The same financial advice has been repeated for decades—by some of the most successful investors in history:

a. Warren Buffett urges patience and long-term thinking in stocks.

b. Peter Lynch reminds investors not to panic during market declines.

c. Ray Dalio talks about diversification across assets—stocks, bonds, commodities, cash—to survive uncertainty.

d. Benjamin Graham warns against reacting to short-term market noise.

This advice applies whether you’re investing in:

- Stocks or equity funds

- Bonds and fixed income

- Gold, commodities, or crypto

- Retirement savings or long-term portfolios

It applies in bull markets and bear markets. In booms and crashes.

Most people agree with it completely.

And yet, when markets fall sharply—like in 1987, 2008, March 2020, or October 2022—something changes. When markets soar—like in 1999, 2021, or during the AI-driven enthusiasm of early 2024—emotion still changes:

People panic.

Or they freeze.

Or they chase what’s already gone up.

Or they abandon carefully built plans “just this once.”

Nothing about the advice was wrong.

Nothing about human intelligence suddenly declined.

But emotion took over.

That recurring gap—between what timeless advice says and what people actually do with their money—is exactly where behavioral finance begins.

The Core Insight: What Behavioral Finance Is Really About

Behavioral finance studies how people behave across financial decisions—investing, saving, spending, holding cash, taking risk—under uncertainty. Pioneered by Nobel laureates like Daniel Kahneman and Richard Thaler, it doesn’t discard logic. Instead, it merges psychology with economics to create a truer, messier, and more fascinating picture of why we spend, save, and invest the way we do. It explains why intelligence is often overruled by instinct and how predictable mental shortcuts lead even the sharpest minds into costly traps.

It applies to:

- How investors react to stock market crashes

- Why bond investors panic when interest rates rise

- Why people rush into commodities or crypto after big gains

- Why savers hold too much cash after traumatic losses

Traditional finance assumes people are rational across all these choices. Behavioral finance starts with a different observation:

When money is involved, emotion reliably overrides logic.

A useful mental model is this:

Your brain evolved to keep you alive, not to manage a diversified portfolio.

It is designed to:

- React quickly to threats (crashes)

- Learn heavily from recent experiences

- Seek safety in groups

- Avoid pain more than pursue gains

These instincts worked well for survival.

They work poorly in modern financial systems that reward patience, diversification, and long time horizons.

Behavioral finance doesn’t dismiss traditional finance. It explains why real-world outcomes often diverge from it—sometimes dramatically.

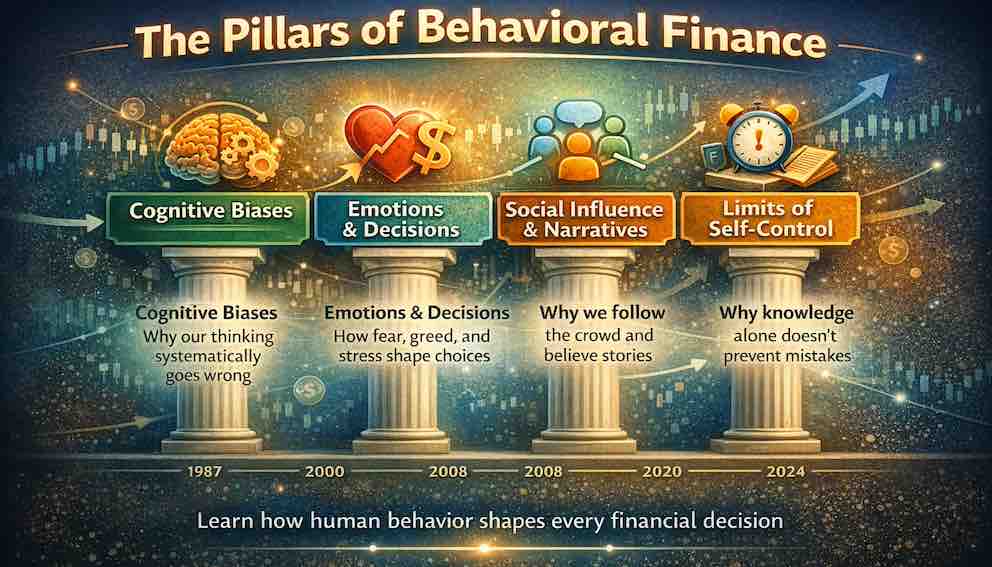

3. The Pillars of Behavioral Finance — With History as Proof

Pillar 1: Cognitive Biases — Why Thinking Goes Wrong Systematically

Cognitive biases distort judgment in stocks, bonds, commodities, and even savings decisions.

- Loss aversion explains why the 1987 crash caused investors to exit equities for years, missing the recovery.

- Recency bias explains why investors poured into tech stocks after years of rapid gains in the late 1990s, believing the boom would never end—and why housing felt like a guaranteed winner in 2006 after years of rising home prices, ignoring signs of an unsustainable bubble.

- Anchoring explains why many investors in 2022 struggled to adjust during the bond and stock market selloffs. They fixated on the high price levels of 2021, believing those values were “normal” or sustainable, and hesitated to sell or adjust portfolios—even though economic conditions, inflation, and interest rates had changed dramatically. This led to delayed reactions and bigger losses than if they had recalibrated based on the current reality.

- Confirmation bias explains why, in January 2026, investors already holding tech and AI stocks found narratives like “AI will transform everything” highly convincing. They focused on news and reports supporting growth and ignored warnings about overvaluation or market volatility, reinforcing their belief that prices would continue to rise—and staying fully exposed

These biases don’t disappear with experience. They intensify when money is at stake.

Pillar 2: Emotions — Fear and Greed Across Cycles

Fear and greed are not abstract ideas. They have timestamps.

- Greed dominated in 1999–2000, 2021, and parts of early 2024.

- Fear dominated in 2002, 2008–09, March 2020, and October 2022.

In 2008, fear caused investors to sell stocks near generational lows.

In 2020, panic selling happened after the fastest crash in history.

In 2022, fear returned not from falling prices alone—but from uncertainty about inflation and rates.

Behavioral finance explains why fear compresses time horizons. Long-term plans collapse into “What if tomorrow is worse?”

Pillar 3: Social Influence and Narratives — Why Bubbles Feel Logical

Bubbles don’t feel irrational while they’re happening.

In 1999, the narrative was “the internet changes everything.”

In 2006, it was “housing never falls nationally.”

In 2021, it was “this time is different—liquidity will never end.”

In early 2024 and again in early 2026 discussions, AI and productivity narratives dominated confidence.

Humans don’t invest in prices alone.

They invest in stories.

Behavioral finance teaches that narratives reduce uncertainty—and that makes them powerful, even when they’re wrong.

Pillar 4: Limits of Self-Control — Why Knowing Isn’t Enough

Even when investors understand history, they struggle to act differently.

Investors who lived through 2008 still panicked in 2020.

Investors who survived 2020 still felt extreme stress in 2022.

Why?

Because bias is permanent.

Experts don’t rely on discipline. They rely on systems:

- Asset allocation rules

- Rebalancing schedules

- Pre-committed decision frameworks

Behavioral finance accepts a hard truth:

You cannot eliminate bias.

You can only manage decisions despite it.

4. Markets Don’t Repeat Exactly — Behavior Does

Prices don’t repeat.

Circumstances don’t repeat.

Human reactions repeat — remarkably well.

Historical echoes:

- 1987: The crash that shocked everyone.

- 1999: The euphoria of the dot-com boom.

- 2009: The despair after the global financial crisis.

- March 2020: Panic in the pandemic sell-off.

- October 2022: Exhaustion after volatile markets.

Different assets. Different triggers. Same psychology.

Behavioral finance gives you the ability to recognize when emotion is driving decisions more than information.

And that alone changes how you respond — calmly, intentionally, and profitably.

5. How Experts Use Behavioral Finance Daily

Experts don’t ask:

“Where will the market be next month?”

They ask:

- Why does risk feel unbearable right now?

- Why does optimism feel obvious now?

- What behavior is being rewarded—and why?

- What are people afraid to do?

When bonds sold off sharply in 2022, experts recognized emotional stress, not just rate math.

When stocks surged in early 2024, experts watched sentiment more than forecasts.

When bubble talk resurfaced in 2026 discussions, experts focused on positioning, not headlines.

Experts don’t feel less emotion.

They just don’t let emotion dictate action.

6. What This Series Will Teach You (And Why It’s Structured This Way)

This series is intentionally progressive:

Part 1: Understanding Yourself

You’ll learn why you behave the way you do under financial stress—and why intelligence alone doesn’t protect against mistakes.

Part 2: Understanding Markets

You’ll learn to recognize emotional cycles, overreactions, bubbles, and crashes—not to predict them, but to avoid being controlled by them.

Part 3: Designing Better Decisions

You’ll learn how experts build systems, rules, and habits that work with human psychology instead of fighting it.

Throughout the series, we’ll repeatedly use a simple behavioral lens:

- What emotion is dominant here?

- What bias does that emotion activate?

- How does this distort decisions or prices?

This lens compounds with practice.

7. What You Will Gain by the End

The goal isn't to "eliminate" your human psychology—that's impossible. The goal is to manage it. You can't stop feeling fear during a market crash, but you can build a financial plan that prevents you from acting on it.

This is the promise of this series.

You won’t gain certainty.

You will gain:

- Emotional distance from market swings

- Better judgment under pressure

- Fewer regret-driven decisions

- A calmer relationship with uncertainty

- The ability to see behaviour before price

That’s the edge experts rely on—quietly, consistently.

8. Reading Isn’t Enough — Practice Is the Point

Behavioral finance must be practiced.

Notice:

- When you feel urgency

- When headlines trigger emotion

- When “doing something” feels safer than waiting

- When narratives feel too convincing

Non-experts react to markets.

Experts observe behavior.

This series will train that observation.

9. Conclusion

Mini takeaway: Behavioral finance explains why markets across stocks, bonds, commodities, and savings don’t just move on data—they move on human psychology.

“In finance, the biggest risk is rarely the market — it’s how we react to it.”

This tutorial set the context: the assets, the history, and the human patterns behind them.

A call for reflection: Which market episode—2008, 2020, 2022, or another—changed your behavior the most? What did you feel in your body at the time?

Next, we’ll explore how the brain actually makes financial decisions, and why fast thinking dominates precisely when long-term thinking matters most.

Once you see that clearly, market behavior stops feeling mysterious.

It starts feeling human.

And that understanding compounds.

Academic References

- Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk.

- Shiller, R. J. (2000). Irrational Exuberance. Princeton University Press.

- Thaler, R. H. (2015). Misbehaving: The Making of Behavioral Economics.

- Barberis, N., & Thaler, R. (2003). A Survey of Behavioral Finance. Handbook of the Economics of Finance

- Lo, A. W. (2005). Reconciling Efficient Markets with Behavioral Finance: The Adaptive Markets Hypothesis. Journal of Investment Consulting

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.