Last Updated: January 16, 2026 at 14:30

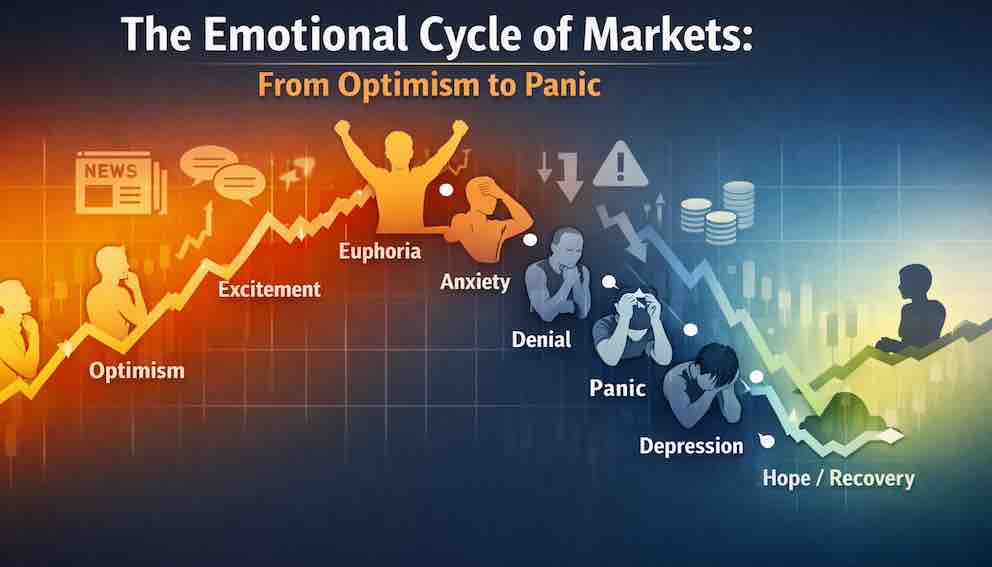

The Emotional Cycle of Markets: From Optimism to Panic - Behavioral Finance Series

Markets aren’t just numbers—they’re mirrors of human emotion. From the cautious hope of Optimism to the reckless highs of Euphoria, and the crushing lows of Panic, every market cycle reflects collective psychology. Understanding these stages—rooted in Magee’s classic “Psychology of a Market Cycle” and Minsky’s Financial Instability Hypothesis—helps investors navigate volatility, manage risk, and spot opportunities, without being swept away by fear or greed. Learn how experts use stress tests, narrative awareness, and pre-committed rules to survive every stage of the emotional cycle.

Imagine you’re at a party. Everyone around you is cheering and dancing, caught up in the excitement. You feel energized and join in. Now imagine the music suddenly stops, and panic spreads—people rush to the exits. That’s how markets feel at scale: collective human emotions create surges of optimism, fear, and everything in between.

Understanding the emotional cycle of markets helps investors avoid being swept away by hype or paralyzed by fear. It doesn’t tell you exactly when prices will rise or fall, but it provides a map to recognize what’s happening and respond wisely.

The Academic Foundation of Market Emotions

The emotional cycle of markets is more than just a set of observations—it’s part of a well-established framework used by investors and researchers for decades.

In the mid-20th century, John P. Magee introduced the “Psychology of a Market Cycle” chart, a visual representation of how investor emotions tend to move through predictable stages. This model was later popularized by firms like Merrill Lynch and has guided countless investors in understanding market behavior.

The cycle also aligns closely with Hyman Minsky’s Financial Instability Hypothesis, which explains how periods of stability can encourage increasing risk-taking, eventually creating financial instability. Mapping Minsky’s stages to market emotions:

- Hedge financing → Optimism/Excitement: Investors are confident but cautious.

- Speculative financing → Euphoria: Risk-taking escalates as optimism turns into exuberance.

- Ponzi financing → Panic/Depression: Excessive leverage and overconfidence lead to instability and sharp corrections.

By connecting psychology with economic fundamentals, this framework shows that markets are shaped not only by numbers and valuations but also by collective human emotion and behavior.

The Emotional Cycle: Stages of Market Psychology

Here’s how markets typically move:

1. Optimism

- Feeling: Hope that the market is improving.

- Behavior: Cautious buying begins.

- Example: Early 2009, investors began returning to equities after the financial crisis.

- Reflective Prompt: Are you willing to invest early, or do you wait for confirmation from others?

2. Excitement

- Feeling: Confidence grows as gains accumulate.

- Behavior: More investors join; media starts covering “hot” sectors.

- Example: Bitcoin surged from $1,000 to $5,000 in 2017, attracting mainstream attention.

- Novice vs Expert: Novices jump in impulsively. Experts evaluate fundamentals carefully.

3. Euphoria

- Feeling: “This time it’s different.” Fear of missing out dominates.

- Behavior: Prices spike; leverage and speculative buying increase.

- Example: Dot-com bubble, 2000—companies with no profits had billion-dollar valuations.

Quantitative Indicators of euphoria:

| Indicator | Typical Reading |

| AAII Bull/Bear Spread | Very high (extreme optimism) |

| Margin Debt | High, fueling speculation |

| Volatility (VIX) | Low, calm markets |

| Valuation | Prices far above long-term averages (e.g., Shiller P/E >30) |

Expert Tip: Experts may trim equity exposure slightly, not to time the peak, but to manage risk.

4. Anxiety

- Feeling: Early signs of trouble appear—slower growth, missed earnings.

- Behavior: Volatility rises; early sellers exit. Market breadth narrows.

- Example: Late 2007, some housing sectors started declining even as indexes held up.

5. Denial

- Feeling: Investors cling to old beliefs. Cognitive dissonance sets in—they reject negative information.

- Behavior: Selling is delayed; narratives rationalize losses (“just a correction”).

- Example: Early 2020, some investors held travel stocks ignoring the impact of global lockdowns.

6. Panic

- Feeling: Fear overwhelms reason; selling accelerates.

- Behavior: Rapid price declines, liquidity dries up, forced selling occurs.

- Example: March 2020, global markets fell 30% in a month.

- Expert Strategies:

- Stress Test Your Portfolio: “If we enter a 2008-style panic, what fails? Do I have enough liquidity?”

- Pre-Mortem Planning: Write down what you will do if your portfolio drops sharply to avoid freezing during panic.

7. Depression

- Feeling: Apathy and despair dominate; few want to invest.

- Behavior: Prices may fall below intrinsic value; sidelined cash accumulates.

- Example: Post-2008, many financial stocks remained depressed for years.

Quantitative Indicators of depression:

| Indicator | Typical Reading |

| AAII Bull/Bear Spread | Extreme pessimism |

| Dividend Yields | High (value opportunities) |

| Volume | Low; few buyers |

8. Hope / Recovery

- Feeling: Optimism slowly returns as markets stabilize.

- Behavior: Smart money re-enters cautiously; media highlights recovery.

- Example: 2009–2010, investors gradually rebuilt positions post-crisis.

Quick Case Comparison: Dot-Com Bubble vs 2008 Financial Crisis

| Phase | Dot-Com Bubble (2000) | 2008 Financial Crisis |

| Optimism | Emerging tech IPOs | Early signs of stable housing and credit markets |

| Excitement | Media hypes internet startups | Rapid growth in housing prices and mortgage lending |

| Euphoria | Skyrocketing valuations | Housing prices and financial products (subprime mortgages, CDOs) soar; leverage peaks |

| Anxiety | Earnings miss; cracks appear | Early mortgage defaults rise; warning signs appear in financial sector |

| Denial | Investors cling to “new economy” | Many investors believe housing issues are localized; systemic risk ignored |

| Panic | NASDAQ drops 78% | Global stock markets crash; major banks fail or require bailout |

| Depression | Retail exits markets | Credit freezes; widespread fear; investors avoid risk assets |

| Hope | Recovery begins post-bubble | Government interventions (stimulus, bailouts) stabilize markets; recovery begins gradually |

Why Markets Follow Emotional Cycles

Key behavioral mechanisms include:

- Herding: Investors mimic others to reduce perceived risk.

- Narratives: Stories like “this time is different” amplify optimism.

- Overreaction/Underreaction: Prices overshoot in euphoria and undershoot in panic.

- Leverage & Liquidity: Borrowing magnifies swings.

- Reflexivity: Perceptions influence fundamentals (rising prices allow capital raises, feeding optimism).

- Cognitive Dissonance: In Denial, investors ignore evidence that contradicts beliefs.

Practical Strategies for Investors

- Scenario Planning: Write best-case, base-case, and worst-case scenarios.

- Pre-Commitment Rules: Decide ahead when to buy or sell.

- Mental Models: Identify which market phase you are in.

- Cooling-Off Periods: Pause before trading to avoid emotional decisions.

- Diversification & Hedging: Reduce exposure to any one sector.

- Narrative Awareness: Distinguish stories from fundamentals.

- Reflective Journaling: Track your emotional state.

- Stress Test & Pre-Mortem: Prepare plans for panic scenarios.

Key Rule: The goal is not to predict the emotional cycle, but to have a financial plan that survives every stage.

Nuances & Limits

- The cycle is a map, not a timer: Markets can linger in any phase for years or move rapidly in weeks.

- Emotions cannot and should not be eliminated. They signal risk or opportunity when interpreted correctly.

- Even rational investors can be temporarily influenced by the crowd.

Clear Takeaway

Markets mirror collective human emotions: optimism, fear, greed, and regret. By understanding the emotional cycle, you can avoid reactive decisions, spot opportunities during despair, and temper exuberance during euphoria.

Reflective Prompt: Next time you feel excitement or panic, ask yourself: “Which stage of the emotional cycle am I in, and am I reacting or acting?”

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.