December 29, 2025 at 18:23

U.S. Federal Debt and Deficits: Why It Matters for You

Authored by MyEyze Finance Desk

Federal deficits and debt are projected to hit record levels from 2025 to 2035, with Social Security, Medicare, and rising interest costs driving growth. Even with steady economic expansion, revenue gains are unlikely to keep pace, putting households, businesses, and the U.S. economy on an unsustainable fiscal path.

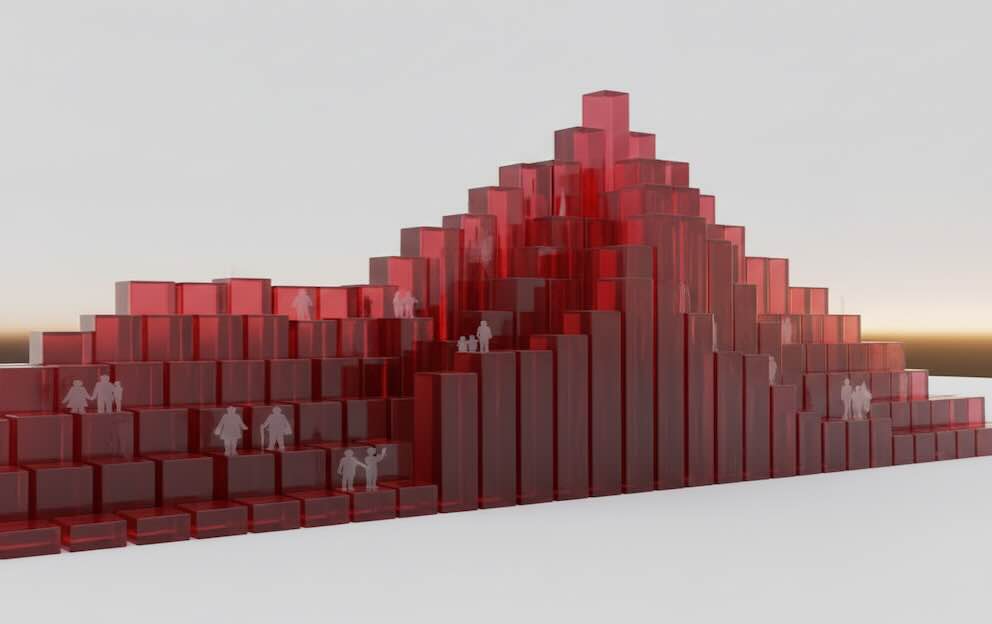

The Congressional Budget Office (CBO) projects that federal deficits will remain historically high over the next decade, with debt held by the public expected to rise from about 100% of GDP in 2025 to 118% by 2035. While these numbers may seem abstract, they have very real implications: they affect the economy, household finances, and the financial future of younger generations. Mandatory spending on Social Security and Medicare, combined with rising interest costs, is driving this trend. Understanding these projections is critical for anyone planning for the economic, personal, and generational impacts ahead.

Even though recent economic strength has modestly improved the 10-year outlook compared to mid-2024 — cumulative deficits over the decade are nearly $1 trillion lower — the trajectory remains unsustainable without major reforms.

Key Takeaways

- Deficits remain large and persistent: The 2025 deficit is projected at $1.9 trillion (6.2% of GDP) and could rise to $2.7 trillion by 2035. Over the decade, deficits will average 5.8% of GDP, well above the 50-year average of 3.8%.

- Debt will surpass previous records: Federal debt held by the public is projected to rise from 100% of GDP in 2025 to 118% by 2035, limiting the government’s ability to respond to crises.

- Mandatory spending and interest dominate: Social Security, Medicare, and interest payments are the main drivers of debt growth. Net interest is already projected to exceed defence spending by 2025 and will continue rising.

- Revenue growth partially offsets spending: Revenues are projected to rise from 17.1% to 18.3% of GDP by 2035, but spending increases — particularly in mandatory programs and interest costs — outpace growth.

- Economic and personal implications are real: High deficits and debt influence inflation, interest rates, job growth, and the government’s ability to fund programs that affect everyday Americans.

Economic Impact

Rising federal debt is not just a fiscal statistic — it has tangible consequences for Americans’ daily lives. The CBO projects net interest payments will nearly double from $952 billion (3.2% of GDP) in 2025 to $1.8 trillion (4.1% of GDP) by 2035. Every dollar spent on interest is one less dollar available for roads, schools, research, or other programs that drive long-term growth. Historical experience reinforces the risk: in the 1980s, rising interest costs forced cuts in public investment, slowing productivity and economic expansion.

High deficits also raise borrowing costs across the economy. As the government competes for funds, mortgages, student loans, and business financing all become more expensive. Research from the Federal Reserve and IMF suggests that a 10% increase in debt-to-GDP can raise long-term Treasury yields by 0.1–0.2 percentage points, directly impacting millions of Americans’ finances.

Debt levels also limit crisis response. In 2008, with debt-to-GDP at 64%, the federal government could deploy significant stimulus. By 2035, with debt projected at 118%, similar interventions would be far more constrained, meaning future recessions could be deeper and longer-lasting.

The compounding effect is clear: higher borrowing costs increase debt service, enlarging deficits further and forcing trade-offs between interest payments and productive investments. Over time, this could slow growth, reduce job creation, and limit fiscal flexibility.

Personal Finance and Generational Implications

The federal fiscal trajectory directly affects households, particularly younger generations. Mandatory spending on Social Security and Medicare is projected to rise from 14% to 15.1% of GDP by 2035, largely driven by an aging population. Without reforms, Social Security’s trust fund could be depleted around 2035, potentially requiring benefit cuts of 20–25% or higher payroll taxes, while Medicare faces similar pressures shortly after. For context, a 2% payroll tax increase could cost the average worker roughly $1,500 annually, linking national fiscal trends directly to personal finances.

Younger workers are likely to shoulder the heaviest burden. Brookings analysis indicates that high debt-to-GDP periods often lead to higher effective taxes for future generations, reducing income, retirement savings, and long-term financial planning.

Rising deficits also affect everyday expenses. Higher interest rates increase mortgage, car, and credit card payments, while growing mandatory spending and interest may crowd out discretionary programs, affecting education, healthcare, and social services. Lower- and middle-income households may feel the pressures most acutely, making financial awareness and proactive planning essential.

Risks and Planning Considerations

The fiscal outlook is sensitive to numerous risks — and the consequences are high. Slower-than-expected economic growth, recessions, or global shocks could sharply increase deficits. The 2020 pandemic provides a stark example: federal debt surged by roughly 20% of GDP in a single year, demonstrating how quickly fiscal pressures can escalate.

Rising interest rates present another risk. Even a 1% increase in long-term Treasury yields could add $200–300 billion annually to interest payments by 2035, crowding out funding for schools, infrastructure, and research. Healthcare costs are similarly volatile, as Medicare and Medicaid expenditures are highly sensitive to medical inflation and demographic changes, with even small deviations potentially increasing mandatory spending by hundreds of billions.

Positive developments could improve the outlook. Faster economic growth or lower interest rates could reduce debt accumulation, increase fiscal flexibility, and provide more government resources for investment. These uncertainties highlight why households, businesses, and policymakers must plan for a range of scenarios: potential tax increases, higher borrowing costs, or reductions in public benefits.

Conclusion

The CBO’s projections make one thing clear: the current fiscal path is unsustainable. Without deliberate action, federal debt will continue rising, potentially slowing growth, limiting fiscal flexibility, and increasing vulnerability to financial crises. Demographic trends — especially the aging population — will drive continued growth in Social Security and Medicare spending, while rising interest costs will claim a growing share of federal resources. By 2035, the window for proactive policy action will have narrowed.

There is no single “fix.” Structural, long-term reforms are needed, balancing spending and revenue and adapting to demographic and economic realities. Adjustments to Social Security and Medicare, revenue policies, or discretionary spending controls may slow debt accumulation, but none alone will resolve structural deficits.

The key takeaway: timely, strategic action matters. The longer reforms are delayed, the more abrupt and disruptive adjustments will be required. Policymakers, households, and businesses alike benefit from understanding the trajectory of deficits and debt, so decisions can be made with the long-term picture in mind. Awareness and preparation are the most effective tools for navigating this slow-moving but serious challenge.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Part of this content was created with formatting and assistance from AI-powered generative tools. The final editorial review and oversight were conducted by humans. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.