Tutorial Categories

Last Updated: January 12, 2026 at 20:25

Why Your Gut Feeling Is Costing You Money in the Markets — Fast vs Slow Thinking (System 1 vs System 2) – Behavioral Finance Series

Most investors think their biggest challenge is choosing the right investments. Behavioral finance shows something more uncomfortable: the biggest risk to your portfolio is how your brain makes decisions. Research in psychology and economics reveals that fast, intuitive thinking — what feels like “gut instinct” — often leads investors to sell too early, buy too late, and panic at the worst moments. Understanding how fast and slow thinking compete for control helps explain why markets behave irrationally and why disciplined, long-term strategies tend to outperform.

How the Brain Makes Financial Decisions

Fast vs Slow Thinking (System 1 vs System 2)

Imagine this moment.

You open your phone. Markets are down sharply. Headlines scream “Worst Day Since…”. Your portfolio is bleeding red. You feel a knot in your stomach. Your finger hovers over the “Sell” button.

Nothing has been calculated yet. No spreadsheet opened. No long-term plan reviewed.

And yet, a decision is already forming.

This is not a failure of intelligence.

It is how the human brain is designed to work.

In Finance world, intuition often feels right at precisely the wrong moment.

To understand why we make the financial decisions we do — and why markets repeatedly swing between greed and fear — we need to understand how the brain actually thinks.

The Central Lesson: Do Not Trust Your Financial Intuition

This may sound uncomfortable, even insulting. We like to believe our instincts are wise.

But behavioral finance delivers a hard truth:

Your financial intuition is optimized for survival, not for investing.

The same brain mechanisms that help you avoid danger, detect threats, and react quickly in uncertain environments systematically misfire in markets.

The Two Systems That Drive Every Financial Decision

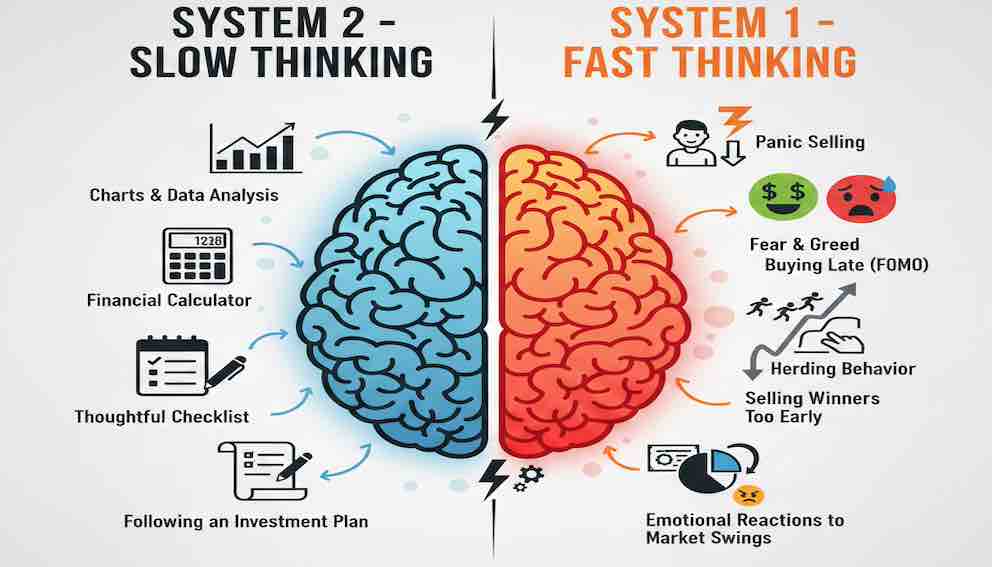

Psychologist and Nobel laureate Daniel Kahneman described human thinking as operating through two interacting systems:

- System 1: Fast, automatic, emotional

- System 2: Slow, deliberate, analytical

These are not physical parts of the brain, but modes of thinking — and both play a role in every financial decision you make.

System 1: Fast Thinking — The Brain’s Autopilot

System 1 is always on.

It reacts instantly, effortlessly, and without conscious control. It is excellent at keeping us alive — but dangerous when managing money.

Characteristics of System 1

- Fast and intuitive

- Emotional and associative

- Relies on mental shortcuts (heuristics)

- Requires little or no effort

System 1 answers questions like:

- “Is this risky?”

- “Does this feel wrong?”

- “What is everyone else doing?”

Real-World System 1 Mistakes Investors Make

1. Selling Too Early — Fear of Losing Gains

A stock rises 40%. System 1 whispers: “Don’t get greedy. Lock in profits before they disappear.”

So investors sell winners too early.

But long-term returns often come from a small number of big winners. Selling early truncates compounding.

This is why many portfolios look busy — lots of trades, lots of “smart” decisions — yet underperform.

2. Buying Too Late — Safety in Numbers

A stock has already doubled. Everyone is talking about it. Media coverage explodes.

Now System 1 feels safe — because everyone agrees.

This is how investors:

- Buy near market tops

- Enter bubbles late

- Confuse popularity with value

System 1 equates social proof with safety, even when prices already reflect extreme optimism.

3. Panic Selling During Market Drops

When prices fall sharply, System 1 activates the same neural circuits used for physical threats.

The goal becomes simple: stop the pain.

Selling feels like relief — even if it locks in losses permanently.

System 2: Slow Thinking — The Rational Analyst

Characteristics of System 2

- Slow and deliberate

- Logical and analytical

- Requires focus and energy

- Can override System 1 — but often doesn’t

System 2 handles tasks like:

- Calculating expected returns

- Comparing alternatives

- Evaluating long-term consequences

But System 2 is effortful. The brain avoids using it unless forced.

Traditional finance assumes System 2 is always in control. Behavioral finance starts where reality begins: System 1 usually flies the plane.

Financial Examples of System 2 at Work

1. Long-Term Investment Planning

Choosing asset allocation based on goals, risk tolerance, and time horizon.

2. Portfolio Rebalancing

Selling assets that performed well and buying those that underperformed — the opposite of what emotions suggest.

3. Tax and Cost Optimization

Understanding fees, taxes, and compounding effects over decades.

System 2 is capable of excellent decisions — but it must be deliberately engaged.

Why System 1 Dominates Financial Decisions

If System 2 is smarter, why don’t we use it all the time?

Because the brain is energy-efficient, not accuracy-optimized.

System 2 consumes mental effort. System 1 is cheap, fast, and usually “good enough.” The brain defaults to System 1 unless forced otherwise.

In financial markets:

- Decisions feel urgent

- Information is noisy and emotional

- Outcomes are uncertain

These conditions strongly favor System 1 dominance.

How System 1 Creates Financial Biases

Most well-known behavioral biases are not random flaws — they are System 1 shortcuts.

Loss Aversion

Losses feel about twice as painful as equivalent gains feel pleasurable.

- Investors hold losing stocks too long

- Sell winners too early

- Avoid necessary short-term losses even when long-term gains are likely

Anchoring

You buy a stock at $100. It falls to $60.

System 1 says: “I’ll sell when it gets back to $100.”

But the market doesn’t know your purchase price. Fundamentals may have changed permanently.

The anchor — your original price — distorts judgment, delaying rational decisions.

Anchors feel logical. They are not.

Even irrelevant anchors shape decisions.

Herd Behavior

If many people believe something, System 1 treats it as safer.

- Market bubbles

- Meme stock manias

- Overreaction to headlines

Following the crowd feels emotionally comforting — even when wrong.

Why Many Active Investors Underperform

These System 1 behaviors explain a powerful empirical fact:

Most active investors underperform simple buy-and-hold strategies over time.

Not because they lack intelligence — but because:

- They trade too often

- Sell winners early

- Buy after confirmation, not before

- React emotionally to volatility

By contrast, passive and buy-and-hold investors accidentally do something brilliant:

They remove System 1 from the decision loop.

Financial Warfare: System 1 Traps vs System 2 Solutions

This is the practical core.

Trap 1: The Overconfident Autopilot (Planning Fallacy)

System 1 in Charge

Assuming a home renovation will cost £30k and take 3 months — based on a best-case story.

Engaging System 2

Getting multiple quotes, adding a 20% contingency buffer, and doubling the timeline based on historical data.

System 2 asks: “What usually happens?”

System 1 asks: “What do I hope will happen?”

Trap 2: The Emotional Hijack (Panic Selling)

System 1 in Charge

Seeing a portfolio drop 10% and immediately selling to “stop the pain.”

Engaging System 2

Referring to a pre-written plan:

“Volatility of X% is expected. I will not sell based on short-term price moves. I will rebalance annually.”

System 2 replaces emotion with policy.

Trap 3: The Effortless Story (Narrative Fallacy)

System 1 in Charge

Buying an asset because a compelling story (“the future of money!”) feels true and is repeated everywhere.

Engaging System 2

Seeking disconfirming evidence, analyzing real utility, and sizing the investment as a small speculative position within a diversified portfolio.

System 2 distrusts stories. It demands evidence.

A Simple Case Study: The Market Crash

Imagine two investors during a market crash.

Investor A (System 1 Dominated)

- Watches prices fall daily

- Feels increasing anxiety

- Sells to “stop the pain”

- Misses the recovery

Investor B (System 2 Engaged)

- Acknowledges emotional discomfort

- Reviews long-term plan

- Rebalances calmly

- Benefits from recovery

The difference is not intelligence — it is which system was allowed to lead.

How to Engage System 2 in Financial Decisions

The goal is not to eliminate System 1 — that’s impossible.

The goal is to design decision environments that force System 2 to show up.

Practical Techniques

1. Pause Rules

Never make major financial decisions immediately. Create mandatory waiting periods.

2. Pre-Commitment

Decide in advance how you’ll act during market stress.

3. Checklists

Structured questions force analytical thinking:

- Has the fundamental story changed?

- Is this emotion-driven?

- What would I advise someone else?

4. Automation

- Automatic Investing: Set up recurring contributions to investment accounts or retirement funds. This ensures you keep investing consistently, even when markets are volatile or emotions run high.

- Rebalancing Rules: Use automatic portfolio rebalancing to maintain your target asset allocation. This prevents chasing winners and selling losers out of panic or greed.

- Saving Mechanisms: Automate transfers to savings accounts, emergency funds, or specific financial goals. This removes temptation to spend and ensures discipline over time.

- Bill Payments & Debt Management: Automate bills and debt repayments to avoid late fees, stress, and impulsive financial decisions.

Why it works: Automation removes emotional interference entirely. Instead of making hundreds of small, emotion-driven decisions each year, you let systems enforce the rational plan you’ve designed. Over time, this builds better habits, reduces behavioral mistakes, and frees your mental energy to focus on strategic decisions rather than reacting to daily market noise.

Why This Matters Beyond Personal Finance

These same mechanisms scale up to entire markets.

- System 1 dominance creates bubbles and crashes

- Media amplifies emotional signals

- Feedback loops reinforce collective behavior

Understanding fast vs slow thinking is not just personal — it is the foundation for understanding market psychology itself.

Key Takeaways

- Your gut feelings evolved for survival, not investing

- Most financial decisions are made by fast, emotional System 1. It dominates under uncertainty and emotion

- System 2 delivers better outcomes — but must be intentionally engaged

- Many investors underperform because they trust intuition

- Passive strategies work partly because they sidestep human psychology

- Better financial outcomes come from better decision design, not more intelligence

When you feel a strong emotional reaction to money, pause and ask:

“Is my Autopilot flying — or is this a job for the Pilot?”

Academic References

- Kahneman, D. (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

- Tversky, A., & Kahneman, D. (1974). Judgment under Uncertainty: Heuristics and Biases. Science, 185(4157), 1124–1131.

- Thaler, R. H. (2015). Misbehaving: The Making of Behavioral Economics. W. W. Norton & Company.

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.