Tutorial Categories

Last Updated: January 12, 2026 at 20:45

Why Smart Investors Still Make Emotional Mistakes : The Hidden Role of Emotions in Money Decisions – Behavioral Finance Series

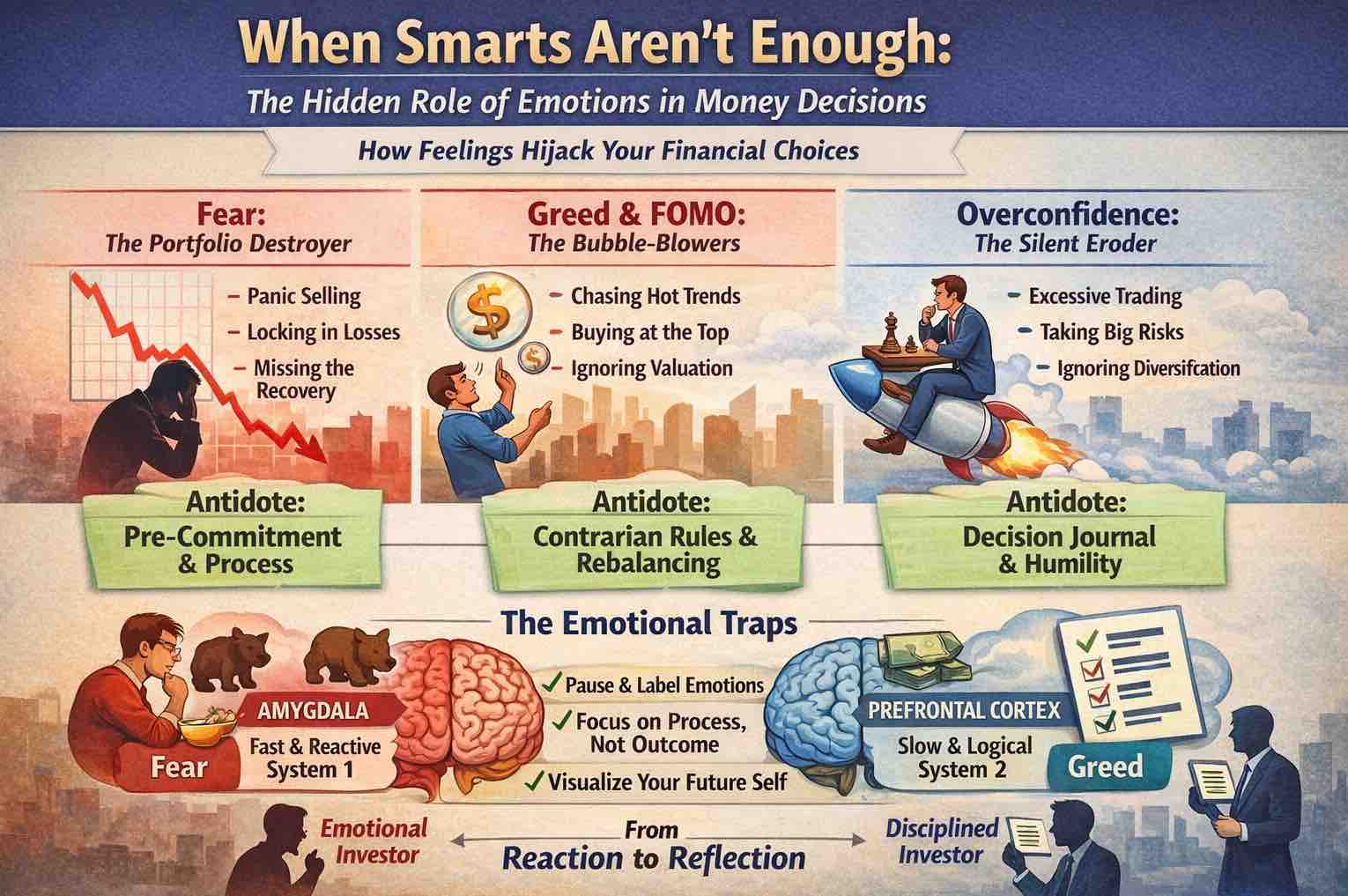

Even the most intelligent investors often make the same mistakes—selling in panic, chasing hot trends, or holding onto losses too long. Why does this happen? In this tutorial, we explore the emotional forces that quietly shape every financial decision: fear, greed, and overconfidence. You’ll learn how these emotions influence market behavior, how experts respond differently under stress, and practical strategies to manage your own reactions. By connecting insights to your past investing experiences, you’ll discover why mastering your emotions is often more important than raw intelligence in achieving long-term financial success.

Imagine this: a brilliant surgeon, who makes life-or-death decisions daily, invests in the stock market—and loses tens of thousands in a week. Or consider a top engineer who confidently buys into a “sure thing investment” only to watch it collapse. Why do the smartest people make such glaring financial mistakes?

The answer is simple: financial success is far more about emotional regulation than IQ. Even raw intelligence can backfire when hijacked by fear, greed, or overconfidence. This tutorial will help you understand the emotional forces shaping your decisions, connect them to your own experiences, and equip you with practical ways to prevent them from controlling your money.

A Quick Note on How Your Brain Works

If you haven’t read our previous tutorial, here’s the key idea: your brain has a fast, intuitive system (System 1) and a slower, analytical system (System 2). While System 2 deliberates carefully, System 1 acts first, often emotionally and reflexively. In finance, System 1 is your autopilot—it reacts to market drops with fear, rallies with greed, and success with overconfidence.

Even experienced investors feel these impulses—but recognizing them is the first step toward control. As you read, think back to your own investing experiences. Where has fear, greed, or overconfidence shaped your decisions?

Part 1: Fear — The Portfolio Destroyer

Fear is the single most common emotion that erodes wealth. It’s what drives panic selling and impulsive moves that lock in losses.

Trigger: Red portfolio statements, market downturns, scary headlines.

System 1 Impulse: Loss aversion—the urge to “stop the bleeding” and sell, even if holding makes more sense.

Cost: Realized losses, missed recoveries, permanent impairment of capital.

Reflect: Think back to a time your portfolio dropped sharply. Did you sell immediately or hold? How did it feel? Did fear make you act against your original plan?

Antidote: Pre-commitment and process. Write down rules for volatility and stick to them: “I do not sell based on price alone.” Use automatic investments, scheduled reviews, and pre-set stop-loss rules to remove emotion from decisions.

Example: In March 2020, many panic-sold S&P 500 equities. Those who stayed the course or adhered to a pre-defined plan captured the full recovery. Fear is natural, but acting on it can be costly.

Part 2: Greed & FOMO — The Bubble-Blowers

Greed and the fear of missing out often drive investors to chase returns at the worst possible moment.

Trigger: Rapid price increases, news of easy money, seeing peers profit.

System 1 Impulse: Herding and overconfidence. The pull to buy what everyone else is buying, or assume “this time is different.”

Cost: Buying at peaks, taking excessive risk, falling for scams, ignoring fundamentals.

Reflect: Recall the last time you invested in a “hot” asset or trend. Were you chasing gains, or following a disciplined plan? How much did excitement influence your choice?

Antidote: Contrarian checklists and pre-set allocation rules. For example:

- Do not chase speculative investments without doing thorough research.

- Rebalance portfolios to sell winners and buy losers.

Example: The 1999 dot-com bubble illustrates this vividly. Even experienced investors chased tech stocks at extreme valuations. Those who stuck to discipline avoided catastrophic losses, while those caught in the hype suffered heavily.

Part 3: Overconfidence — The Silent Eroder

Overconfidence quietly undermines returns by distorting risk perception and encouraging unnecessary action.

Trigger: A string of successful trades, persuasive narratives, or market euphoria.

System 1 Impulse: Illusion of control—believing you can predict outcomes and acting as if luck played no role.

Cost: Excessive trading, fees, tax inefficiencies, concentrated portfolios, and potential catastrophic losses.

Reflect: Think of a trade or investment where you felt “I understand this perfectly.” Did it go as planned? Did confidence turn into overexposure?

Antidote: Humility and data. Keep a Decision Journal recording your rationale, expected outcomes, and results. Review long-term statistics showing that most active traders underperform. Recognize luck’s role in success, and let experience guide measured, systematic actions.

Part 4: Why Emotion Often Outweighs Logic

Emotions drive our investing decisions because they evolved to keep us safe—quick, instinctive reactions once helped our ancestors escape predators or seize opportunities for survival. Today, the same neural instincts can misread a falling stock as a threat and a surging market as an irresistible opportunity.

The Certainty Illusion: Our brains crave narrative and certainty. A simple story about a stock or market trend often feels more convincing than probabilistic truth:

- “This stock will go up because of X”

- vs. “Its future value is a distribution of possible outcomes”

Social Proof as Emotional Fuel: Our instinct to fit in drives herd behavior. When others make money, greed can take hold; when fear sweeps the crowd, panic follows. This emotional contagion moves through the market, affecting decisions even among careful, rational investors.

Reflect: Recall times you acted because “everyone else was doing it” or avoided action because “everyone was panicking.” These moments reveal how deeply social emotions shape decisions.

Part 5: Learning from Your Own Experiences

Almost everyone has made emotional financial mistakes. The key is recognizing patterns:

- Buying high and selling low.

- Chasing “hot tips” or easy stories.

- Ignoring diversification out of pride.

- Anchoring to past prices instead of evaluating current value.

Experts don’t eliminate emotions—they manage them. They follow pre-set rules, maintain perspective, and separate process from outcome.

Reflect: Consider your most painful or surprising financial decisions. Were emotions the driver? How might a simple, pre-defined rule have changed the outcome?

Part 6: Practical Tools to Harness Emotions

While emotions cannot be eliminated, they can be trained. The goal is to create space between feeling and action:

- Pause and Label: Name the emotion: “This is my fear of loss talking.” It reduces intensity and engages reflection.

- Design Your Environment: Remove triggers—delete trading apps, reduce portfolio statement frequency, or make impulsive actions harder.

- Focus on Process, Not Outcome: Evaluate decision quality, not short-term gains or losses. “Did I follow my plan?” matters more than stock price fluctuations.

- Future-Self Visualization: Imagine your 70-year-old self. What decisions would they thank you for today? This strengthens long-term discipline.

- Scenario Analysis: Consider best-case, worst-case, and base-case outcomes. Anticipating possibilities reduces emotional hijacking.

- Scheduled Reflection: Dedicate weekly time to review portfolios calmly, away from daily market noise.

These strategies turn emotion into an ally rather than an enemy, transforming raw intelligence into real-world results.

Part 7: The Bottom Line

Intelligence alone does not make a successful investor. Emotional discipline—awareness, reflection, and pre-commitment—is the real skill that turns knowledge into wealth.

Fear, greed, and overconfidence are predictable, and recognizing them allows you to respond rationally, not reactively. In finance, emotional management is a higher form of intelligence. You are not just managing money—you are managing your reactions to money.

Academic References

- Kahneman, D. (2011). Thinking, Fast and Slow.

- Tversky, A., & Kahneman, D. (1974). Judgment under uncertainty: Heuristics and biases. Science

- Thaler, R. H. (2015). Misbehaving: The Making of Behavioral Economics.

- Odean, T. (1998). Are investors reluctant to realize their losses?

- Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor sentiment. Journal of Financial Economics

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.