Last Updated: January 31, 2026 at 19:30

The Psychology of Investing How Your Brain Can Be Your Worst Enemy (And How to Fix It) - Introduction to Investing Series

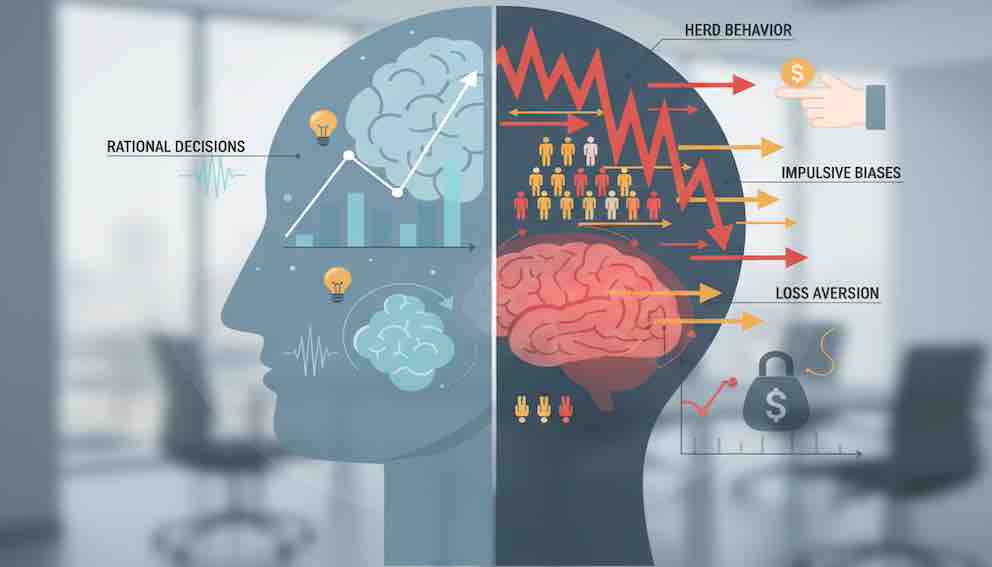

Successful investing requires more than financial knowledge—it demands mastering your own mind. This tutorial explores the hidden psychological traps that trip up beginners, from the fear of missing out (FOMO) to the pain of loss aversion. Learn how behavioral biases like overconfidence and herd mentality sabotage decisions, and discover practical, evidence-based strategies to build discipline. By understanding your investing psychology, you can avoid emotional mistakes, curb overtrading, and stick to a wealth-building plan.

Introduction: The Tale of Two Investors

Meet Leo and Sam. Both are beginners with £5,000 to invest.

- Leo feels excited. He reads news about a soaring tech stock, fears missing out, and invests all £5,000. When it drops 20%, he panics and sells. He then hears about a "can't-miss" crypto and buys in, only to see it fall too. Frustrated, he starts trading more frequently, trying to recoup losses, but only racks up fees and locks in more losses. Within a year, his £5,000 is worth £3,200. He feels defeated and thinks investing is just gambling.

- Sam feels cautious. She writes a simple plan: "Invest £100 weekly into a global index fund for 10+ years. Ignore the news." She automates the transfers. When markets drop, her plan reminds her this is normal—she's actually buying shares on sale. In a year, her portfolio is up and down, but she hasn't made a single emotional decision. She sleeps well.

Their knowledge was similar. Their psychology was not. Investing isn't played against the market; it's played against your own brain. This tutorial is your guide to winning that inner game for the long term.

Part 1: Your Brain's Built-In Biases (And Why They Backfire)

Your brain is wired for survival in a simpler world, not for optimizing a modern investment portfolio. These ancient instincts become systematic financial flaws.

Bias 1: Loss Aversion – "The Pain of Losing Hurts Twice as Much"

- The Instinct: Neuroscience shows your brain registers financial loss similarly to physical threat. Losing £100 feels about twice as bad as winning £100 feels good.

- The Investing Trap: This leads to selling winners too early ("I'd better take my profit!") and holding losers too long ("I'll sell when it gets back to what I paid"). You lock in small gains but let losses run, which is a direct recipe for poor long-term returns.

- Relatable Analogy: It's like refusing to leave a terrible movie because you've already paid for the ticket (the "sunk cost fallacy").

Bias 2: Herd Behavior & FOMO – "If Everyone's Doing It, It Must Be Safe"

- The Instinct: In our tribal past, following the crowd was a survival strategy. In markets, it's often a danger signal.

- The Investing Trap: This is Fear Of Missing Out (FOMO) in action. You buy Bitcoin, meme stocks, or the latest hot fund after it's already skyrocketed, simply because everyone is talking about it. You become the last one in before the downturn, buying high when you should be cautious.

- Relatable Analogy: Joining a huge queue for a trendy restaurant without checking reviews. The crowd feels like validation, not a warning of overhyped prices.

Bias 3: Overconfidence – "I Know More Than I Actually Do"

- The Instinct: After a little success or research, we confuse familiarity with expertise. This is especially common after a few winning trades.

- The Investing Trap: You believe you can "time the market" or consistently pick individual winners. This leads to overtrading—constantly buying and selling. Each trade may seem small, but they quietly rack up transaction fees and tax bills (on realized gains), creating a significant drag on your returns over years. It also leads to concentrated portfolios (putting all eggs in one basket), which is incredibly risky.

- Relatable Analogy: After watching a few tutorials, you believe you can rebuild a car engine. The overconfidence leads to a costly breakdown.

Other Common Biases to Watch For:

- Recency Bias: Overweighting the most recent market trends. If stocks have been up for months, you assume they'll keep going up. If they've been down, you assume they'll keep falling. This blinds you to long-term cycles.

- Anchoring: Getting emotionally fixated on a specific price, like the price you paid for a stock. If it falls, you anchor to your purchase price, refusing to sell until it "gets back to even," even if the fundamentals have deteriorated.

Part 2: The Emotional Rollercoaster & Common Beginner Mistakes

These biases fuel specific, costly behaviors. See if you recognize yourself here.

Mistake 1: Panic Selling

- The Scene: The market drops 10% in a week. Headlines scream "CRASH!"

- The Reaction: Pure fear takes over. You sell your investments to "stop the bleeding."

- The Cost: You turn a paper loss (temporary and unrealized) into a realized loss (permanent). You also guarantee you'll miss the inevitable recovery. It's like selling your house during a neighborhood price dip.

Mistake 2: Chasing Performance (The "Rear-View Mirror" Error)

- The Scene: A stock or fund is up 80% this year. Financial media celebrates it.

- The Reaction: You buy it, projecting past performance directly into the future.

- The Cost: You buy at the peak. Assets that go up fast often correct sharply. You're chasing the rocket after it's launched.

Mistake 3: The Overtrading Spiral

- The Scene: Boredom or a desire for action sets in. You check your portfolio constantly.

- The Reaction: Every piece of news or minor price move triggers an urge to "do something." You trade frequently to feel in control.

- The Cost: Beyond fees and taxes, you amplify mistakes and stress. Studies show that the most active traders often achieve the lowest returns. Activity is the enemy of the long-term investor.

Part 3: Building Your Long-Term Psychological Defense System

Knowing your enemy is step one. Step two is building permanent fortifications. Your defenses aren’t just for today—they’re for maintaining calm through weeks, months, or even years of market swings.

Defense 1: The Written Investment Plan (Your Unshakeable North Star)

This is your single most powerful weapon. Before you invest a penny, write this down:

- My Goal: (e.g., "£50,000 for a house deposit in 8 years")

- My Strategy: (e.g., "Automate monthly investments into two low-cost ETFs")

- My Rules: (e.g., "I will not sell unless my goal changes. I will rebalance once a year. I will not invest in individual stocks.")

- When fear or greed strike, re-read your plan. It's your binding contract with your rational self.

Defense 2: Automate Everything (Remove Yourself from the Equation)

Set up a standing order from your bank to your investment account. Automate the purchase of your chosen funds. This is dollar-cost averaging in action—you buy consistently, whether markets are up or down, smoothing out your purchase price. Emotion and the temptation to time the market are eliminated.

Defense 3: Implement the "24-Hour Rule" & Emotional Log

For any decision NOT covered by your plan, impose a mandatory 24-hour waiting period. Go further: keep a simple "Impulse Journal." When you feel the urge to trade, jot down:

- Date & Time

- The urge (e.g., "Sell my tech fund!")

- The trigger (e.g., "Saw a scary headline")

- The emotion (e.g., "Fear")

- Reviewing this log over time reveals your personal emotional triggers, helping you disarm them faster.

Defense 4: Curate Your Information Diet

- Unfollow/Mute: Financial news channels, fear-mongering headlines, and social media "finfluencers" showing off gains.

- Follow: A short list of long-term, evidence-based sources.

- You cannot be panicked by news you don't consume. Protect your attention to protect your portfolio.

Defense 5: Reframe Your Mindset

- On "Losses": Don't think "I'm losing money." Think: "The market is having a sale. My next automatic investment will buy more shares for less."

- On Volatility: View short-term swings not as threats, but as the inevitable and necessary entry fee for long-term returns. If investing felt safe and smooth every day, everyone would do it and the rewards would be minimal.

Interactive Reflection: The "Why Am I Doing This?" Check

Before any trade, ask these three questions. Write down the answers.

- "Is this action part of my written plan?" If NO, stop immediately.

- "Am I acting on new, fundamental information or just on price movement/emotion?"

- "What would I tell my best friend to do in this exact situation?" (We are often wiser for others than for ourselves.)

This practice builds the critical mental muscle of self-awareness, separating your rational investor self from your emotional reactor self.

Conclusion & Key Takeaways: Become the Observer, Not the Reactor

Investing success is less about finding the next superstar stock and more about not sabotaging yourself. Your brain comes with outdated software for the modern financial world, but you can install the right patches.

Your New, Sustainable Mindset:

- You are not your portfolio. Its daily value is not a scorecard of your intelligence or worth.

- Process over prediction. Focus on controlling your system (saving rate, asset allocation, costs) rather than trying to predict the uncontrollable (market movements).

- The goal is not to eliminate emotion (impossible), but to install systems that prevent emotions from driving the car. Your plan, your automation, and your rules are that system.

By understanding loss aversion, you can hold through downturns. By recognizing herd behavior, you can avoid buying bubbles. By admitting overconfidence, you can choose simple, diversified investments and avoid the fee-heavy trap of overtrading.

Remember Leo and Sam: One was a prisoner of psychology, reacting to every short-term swing; the other used systems to achieve long-term calm. Your journey is to move from Leo's stressful reactivity to Sam's disciplined, systematic approach. The market will do what it does. Your psychology—and the defenses you build around it—is the only thing you can, and must, control to succeed.

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.