Last Updated: January 31, 2026 at 19:30

Understanding Market Cycles & Volatility: A Beginner’s Guide to Navigating Bull and Bear Markets - Introduction to Investing Series

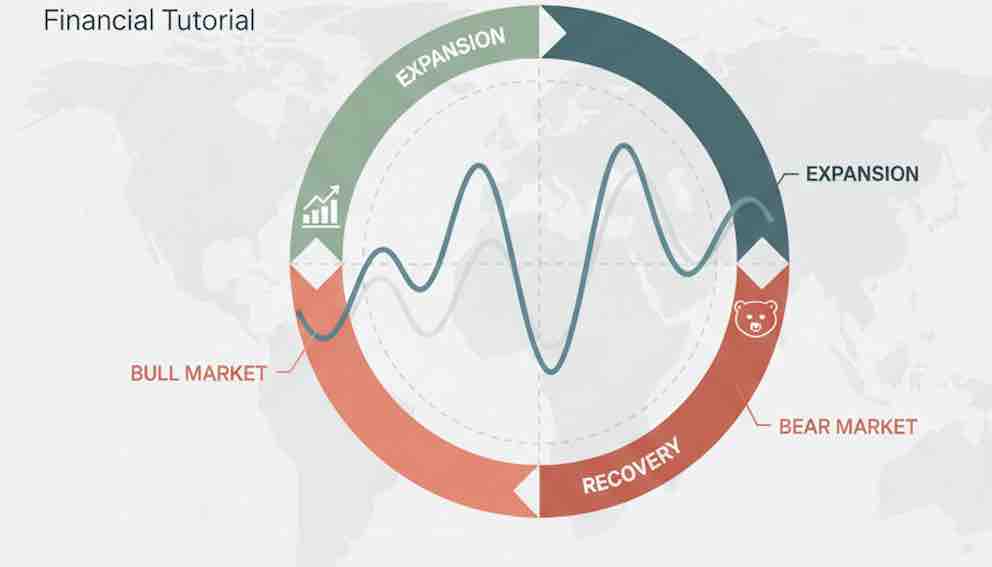

Markets don't crash—they change seasons. This guide reframes bull markets, bear markets, and volatility as predictable cycles, like winter, spring, summer, and fall. Learn what each "season" means for your portfolio, the common emotional traps to avoid, and the simple, disciplined actions that ensure you grow wealth through every turn of the market. Stop fearing volatility and start using an understanding of cycles to your advantage.

Introduction: Your Portfolio's Eternal Seasons

Imagine if every winter, people panicked, declaring "Cold is here forever!" and sold their coats and heaters. It sounds absurd because we know seasons are cyclical. Investing has seasons too, but without a calendar, they can feel chaotic.

Understanding that bull markets, bear markets, and volatility are not random chaos, but part of a recurring cycle, is the key to investing without fear. This tutorial will map the Four Seasons of Investing for you. When you know what season it is, you know how to dress—or in this case, how to behave with your portfolio.

Season 1: SPRING (The Early Bull Market)

- The Scene: The thaw. Markets are rising from a low point. Economic indicators like GDP start to grow, and unemployment may begin to fall. Sentiment shifts from fear to cautious hope.

- Investor Psychology: Relief mixes with skepticism. Many, still wounded from the last winter, are slow to believe the recovery.

- Historical Echo: The recovery years after the 2008 Financial Crisis (2009-2012) or the rebound from the COVID crash in late 2020.

- The Beginner's Trap: Waiting for "one more dip" to get in, and missing the sustained upturn.

- The Smart Move: This is a prime planting season. Continue or begin your regular investments (Dollar-Cost Averaging). This is the time to build or add to your diversified, all-season portfolio of global stocks, bonds, and other assets.

Season 2: SUMMER (The Full Bull Market)

- The Scene: Peak growth. Markets hit new highs. The economy is strong—low unemployment, solid corporate profits. Optimism is rampant. The news is full of success stories.

- Investor Psychology: Greed and overconfidence take hold. The belief that "this time it's different" becomes common.

- Historical Echo: The extended bull market from roughly 2013 to early 2020, characterized by steady growth and low volatility.

- The Beginner's Trap: Chasing performance. Abandoning your diversified plan for "hot" stocks or sectors, and taking on too much risk.

- The Smart Move: Harvest and maintain. Stick to your asset allocation. This is when rebalancing is crucial—sell a bit of your winning stocks to buy bonds or other lagging assets, locking in gains. Do not increase risk because everything feels easy.

Season 3: FALL (The Toppy, Volatile Market & Early Bear)

- The Scene: The first chill. Volatility spikes. Economic warnings appear—inflation may rise, central banks hike interest rates to cool the economy. Some sectors decline sharply (a drop of 20%+ defines a bear market).

- Investor Psychology: Denial, then anxiety. "It's just a pullback," turns into "Why is this happening?"

- Historical Echo: Late 2007 to early 2008, or the first half of 2022, when rising inflation and interest rates sparked sharp declines.

- The Beginner's Trap: Panic selling. Seeing your portfolio value drop and selling to "stop the pain," which turns paper losses into real, permanent ones.

- The Smart Move: Check your foundations, don't flee the house. Revisit your financial plan and time horizon. Money needed for a short-term goal (<5 years) should not be in stocks. For long-term goals (10+ years), do nothing but continue your DCA. Your monthly investment now buys more shares for the same money.

Season 4: WINTER (The Deep Bear Market)

- The Scene: The freeze. Widespread declines. The economy contracts—GDP falls, unemployment rises. Pessimism is thick. Headlines are dire.

- Investor Psychology: Fear and despair. The urge to sell everything and hide in cash is overwhelming.

- Historical Echo: The depths of the 2008 Financial Crisis or the March 2020 COVID crash.

- The Beginner's Trap: Abandoning the plan completely. Going to 100% cash at the bottom, guaranteeing the loss and missing the inevitable spring recovery.

- The Smart Move: Survival and opportunistic planting. This is the ultimate test. If your goal horizon is long-term, your only job is to not sell. Continuing your DCA here builds incredible future wealth. A truly all-season portfolio will include bonds, cash, or other defensive assets that provide stability during this freeze.

Understanding Volatility: It's the Mountain Trail, Not the Rollercoaster

Volatility isn't a sign of danger; it's the terrain of the market. Think of your long-term investment journey as hiking up a mountain.

- The long-term upward trend is the path to the summit (wealth creation).

- Volatility is the rocks, switchbacks, and occasional steep drops on the trail.

- Checking your portfolio daily is like staring at your feet—you'll only see the scary rocks. Looking at the long-term chart is like seeing the whole trail map, where the bumps fade into the overall ascent.

The math that calms nerves: Since 1928, the S&P 500 has had a positive return in roughly 75% of all years. The negative years are the winters—inevitable, but temporary.

Your All-Weather Investment Action Plan

Your strategy should not change with the seasons. It should be designed for all of them.

- Build an All-Season Portfolio (Your Shelter): This is your diversified mix. A core of global stocks and bonds, with possible satellite allocations to assets like real estate (REITs) or commodities via ETFs, can provide balance. This shelter is built before the storm.

- Automate Your Contributions (Your Steady Supplies): DCA is your automated delivery of supplies, rain or shine. It ensures you buy in every season, especially the fruitful winters.

- Write a Personal Investing Constitution: On a calm day, write this down: "I will not sell investments during a market decline. I will rebalance once a year. I will not invest money I need within 5 years." This is your rulebook for when emotions run high.

- Curate Your Information Diet: In winter, financial news is a blizzard of fear. In summer, it's a festival of greed. Limit your exposure. Your plan matters more than the headlines.

Conclusion: You Are Not a Forecaster, You Are a Gardener

Your goal is not to predict the next season. Even the best meteorologists get it wrong. Your goal is to be prepared for all of them.

- You don't panic when winter comes; you trust in the seeds (your diversified portfolio) you planted and the supplies (your DCA) you have.

- You don't get reckless in summer; you patiently harvest (rebalance) and tend your garden.

- The cycle is your ally. Winter's low prices create the opportunity for spring's growth. Your time horizon is your greatest asset—it gives you the privilege to wait out the cold.

By internalizing this seasonal mindset, you decouple your emotions from market movements. The fear of a "crash" is replaced with the recognition of "winter." This shift alone will make you a more successful, resilient investor than any stock tip ever could. Stay disciplined through the seasons, and your portfolio will blossom over the long run.

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.